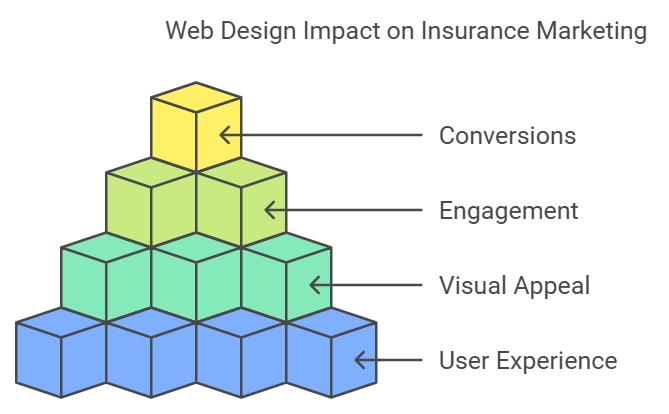

In the fast-paced digital era, the insurance industry has witnessed a transformation in how it connects with clients. Web design has become an indispensable tool for shaping user experiences, building trust, and driving conversions. For insurance companies, where decisions often involve complex details and significant life impacts, a well-designed website can be the key to success. It serves not only as an information hub but as a bridge that guides users toward meaningful actions—like purchasing a policy or reaching out for more details.

Let’s explore how web design can elevate insurance marketing while ensuring your brand resonates with its audience.

Building Trust Through Web Design

Insurance, at its core, is about trust. Prospective clients want to feel secure, confident, and valued before making decisions about policies that may affect their health, property, or family’s future. A website’s design plays a crucial role in fostering this trust.

Visual aesthetics immediately set the tone. A clean, professional website design with ample whitespace and consistent color schemes communicates clarity and organization. Thoughtful branding through well-chosen fonts and imagery can subtly convey reliability. For instance, the use of soft blues or greens may evoke feelings of calmness and security, while bold accents direct attention to key elements like calls to action.

Beyond aesthetics, transparency in functionality builds confidence. Information should be easy to access, with clear menus guiding users to policies, FAQs, and contact pages. Interactive elements such as live chat options or customer service portals can enhance the experience, allowing users to feel supported and valued throughout their journey.

Simplifying Complexities for Seamless Navigation

The world of insurance is inherently complex. Terms like “deductibles” and “premiums” often require careful explanation. Effective web design transforms these complexities into accessible, digestible content. The structure of a website plays an integral role in this process.

Intuitive navigation is essential. Users should never feel lost when searching for information. Logical categorization, breadcrumb trails, and sticky navigation bars can provide continuity, ensuring users know where they are and what to do next. The content should anticipate and answer their most pressing questions without overwhelming them.

Interactive features, such as coverage calculators or risk assessment tools, can make the process of choosing a policy more engaging. These tools empower users by providing immediate, personalized feedback, helping them feel confident in their decisions. Similarly, FAQ sections with dropdown menus or toggleable content can help present information in manageable portions, preventing users from feeling inundated by long blocks of text.

The Role of Mobile Optimization

With the majority of web traffic now coming from mobile devices, ensuring a site’s responsiveness is more critical than ever. Mobile-optimized design involves more than just resizing elements to fit smaller screens; it’s about reimagining the user experience for touch-based navigation and on-the-go accessibility.

For insurance websites, this might mean streamlining forms to include only essential fields or ensuring that buttons are large enough to tap without frustration. Load times are another critical factor. If a site takes too long to load, potential clients may abandon it entirely. Optimizing images, compressing files, and prioritizing speed can prevent this from happening.

Furthermore, mobile design should account for context. A user browsing on their phone might need quick access to contact details or a quote tool, while desktop users may be looking for in-depth policy comparisons. Designing with these differences in mind ensures that every interaction feels purposeful and efficient.

Personalization as a Marketing Superpower

Every insurance client has unique needs, and web design can reflect this individuality through personalization. For example, visitors from regions prone to specific risks, such as hurricanes or earthquakes, could see prominently displayed policies addressing those concerns. Similarly, young families might be directed toward life insurance bundles that account for both parents and children. These subtle adjustments make a site feel relevant, showing users that their needs are understood.

Dynamic elements, like chatbots that adapt responses based on user input, add another layer of personalization. These features not only improve engagement but also reduce the likelihood of users seeking solutions elsewhere.

Visual Storytelling and Content Clarity

Content on an insurance website should inform, guide, and reassure. Visual storytelling can turn dense policy details into engaging narratives. Infographics, short videos, or animated walkthroughs can explain coverage options in ways that feel approachable and easy to understand.

For example, instead of listing the steps to file a claim, an animated explainer video could show a character completing the process seamlessly. This not only humanizes the content but also breaks down potential barriers of intimidation or uncertainty.

At the same time, the text should remain concise yet informative. Headings, subheadings, and well-placed CTAs guide the reader’s journey while emphasizing key points. Every word should serve a purpose, whether it’s clarifying a policy or encouraging users to take action.

The Importance of Analytics in Continuous Improvement

A website isn’t a “set it and forget it” tool—it requires ongoing evaluation and refinement to perform at its best. Analytics provide valuable insights into user behavior, showing which pages are effective and which may need improvement.

Heatmaps can reveal areas where users are spending the most time, while bounce rates highlight where they may be leaving. Split-testing different layouts, colors, or CTAs allows companies to optimize their design based on real-world results. For insurance companies, this data is gold. It ensures that the site evolves alongside client expectations, remaining relevant and effective in driving conversions.

Your Partner in Insurance Web Design Success

Web design is a powerful tool in insurance marketing, but crafting the perfect site takes expertise and dedication. At Thought Media, we specialize in creating websites that are not just visually stunning but also strategically built to convert.

Our team understands the unique challenges of the insurance industry. From mobile optimization to personalized user journeys, we combine creativity with data-driven insights to build sites that drive results. Ready to elevate your brand? Let Thought Media handle the design while you focus on what you do best—helping your clients secure their future. Contact us today and discover how a thoughtfully designed website can transform your insurance marketing strategy.

0 Comments